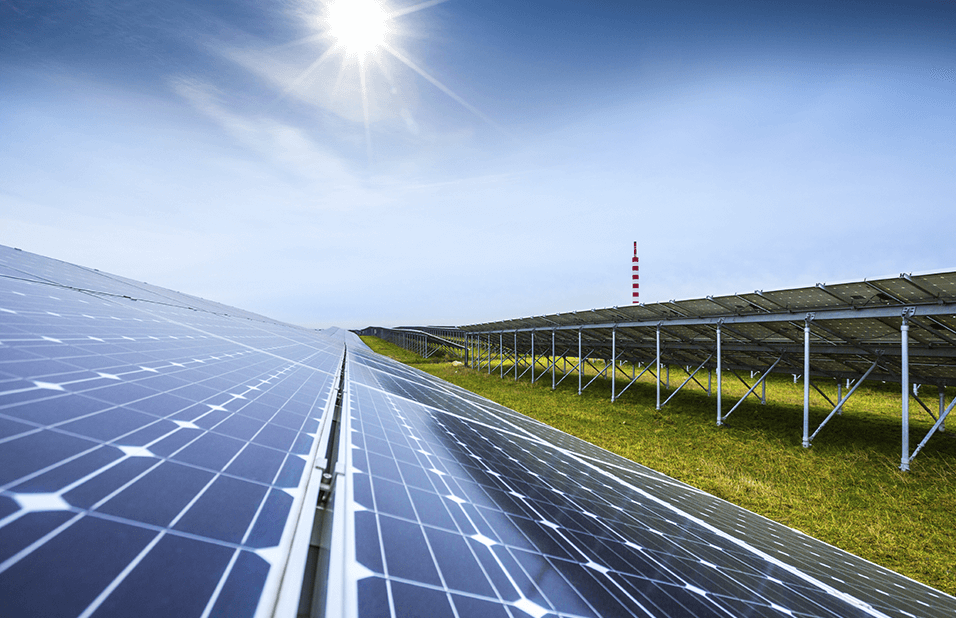

Solar PV deployment this year in the EU was the fastest in the technology’s history, industry advocates SolarPower Europe have calculated.

Defying the continuing pandemic, the year’s installation of 25.9GW across 27 EU member states plus Norway raced 34% ahead of 2020’s connections, a rate surprising even the trade body.

The previous annual record, 21.4GW of new capacity installed in 2011, is relegated to a time when now-dwindling direct subsidies ruled much of Europe’s renewables landscape.

Germany emerges from the lobbyists’ EU Market Outlook 2021 as Europe’s biggest solar market this year, with 5.3GW of new capacity. Spain takes second place on 3.8GW. The Netherlands installed 3.3GW, Poland 3.2GW and France 2.5GW.

Rich streams of investment linking PV farms to utility-scale storage, allied to rising generation efficiencies and innovations such bi-facial, dual-facing panels, pushed Europe’s photovoltaics this year to their ever-warming place in the sun.

Only shortages in supply chains, logistics problems, project implementation delays and consequent product price hikes prevented higher totals, the report indicates.

In future expansion foreseen under the report’s medium-growth scenario, Ireland’s predicted surge of 120% year-on-year to 2025 tops the EU league, albeit from the continent’s lowest deployed PV base, now only 100MW. But even mature solar markets like Germany, Spain and France are predicted to post compound growth in generating power, averaging 20% each year till mid-decade.

In Britain, trade body SolarEnergyUK is asking D-BEIS to guarantee policies smoothing the path to 2.6GW of new capacity every year this decade, up from around 14GW now.

Tripling the UK’s total towards the 40GW judged necessary by the Climate Change Committee, scientific advisors to the government, will require compound annual growth of 11%. Ambitious in Whitehall’s terms, that’s still around half the growth predicted this decade by SolarPower Europe for markets already ahead of Britain, such as Germany and Spain.

Is China’s hold on solar manufacturing weakening?

Manufacturing capacity for solar components among the EU 27, plus Norway hollowed out in the past decade, since Brussels accused China of endemic dumping during trade disputes in the early 2010s. But SolarPower Europe’s analysts say that corner is now turned, with increased investment in higher-value solar PV kit and a quest for shorter supply chains driving recent European growth.

A total of nine inverter manufacturers, including Germany’s SMA and Austria’s Fronius, account for around half the production jobs in EU solar, the researchers calculate.

In polysilicon purifying, Wacker Chemie in Germany is the EU’s only significant producer, its output of 60 tonnes translating into over 20GW of cell or module products per year.

Solar cell production capacity stands at only 0.8GW across the EU. But since 2020, cell-makers Meyer Burger in Germany and Entel in Italy have between them opened 0.3GW of new production. Both have announced further expansion, together targeting 10GW by 2027.

Shocks over dominant Chinese solar manufacturers using slave Uyghur labour from detention centres in Xianjiang province, as evidenced in a Sheffield Hallam University study in May, receive no mention in SolarPower Europe’s report.

But at the time the Brussels-based body and its British counterpart SolarEnergyUK were both quick to issue statements of concern, pledging both organisations’ members to step up transparency disclosures shedding light labour used in component origination and supply.

Good news, but would be great if equipment used in Europe can be made in Europe.

Thank you, Stephen. In the story, I touch on the point you raise. I draw on material contained in SolarPower Europe’s report. You can read up too via the link in my text.

A Happy New Year to all readers of The Energyst. AT.