New analysis from LCP’s Energy Analytics team highlights the growing opportunity for batteries to play both a larger role in the UK energy system’s net zero transition and reduce the reliance on gas. Investment in longer duration batteries is growing with investors turning their attention to the Balancing Mechanism (BM) and Capacity Market (CM) for future revenue streams.

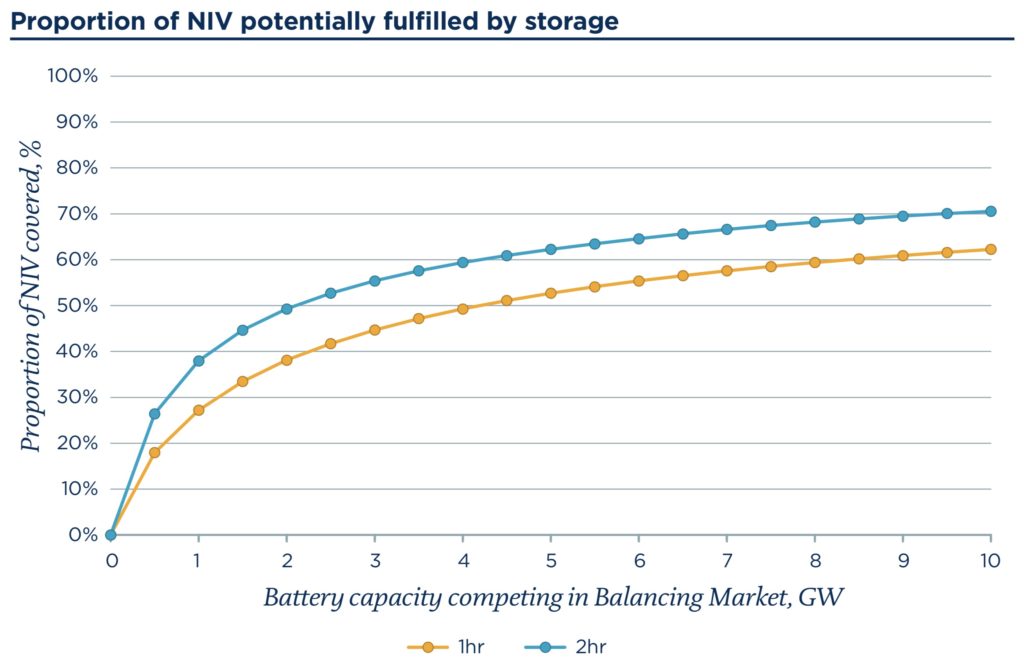

Analysis from LCP indicates that with 4GW of battery capacity, up to 50% of the BM demand could be met in the future by batteries. Meanwhile, if battery capacity was increased to 10GW, up to 70% of BM demand could be met. In 2021, gas acted as the dominant provider of energy to the BM, representing 78% of volume over the year.

A future BM market that is less reliant on volatile gas prices and supported by battery capacity instead, to meet short term demands, could result in cheaper energy bills for consumers.

Chris Matson from LCP commented, “In the 2025/26 T-4 auction we saw 3.3GW of new battery storage assets secure contracts, compared to less than 2GW currently on the system. With previous auction results considered, this could mean that by 2025/26 we have a total of 6GW of battery storage online, much of which will be targeting the Balancing Market, where we have seen lucrative returns in recent months. However, investors will need to closely consider how increasing competition and the impact of cannibalisation could affect returns as they assess their future revenues.”

For investors looking to the Capacity Market, in the past this has offered limited opportunities for battery assets due to the limited duration of the systems, often at just one hour, resulting in batteries being heavily derated in the CM. However, with more investment being made in longer duration batteries, the CM market is now set to come into play for asset owners, providing a reliable revenue stream for battery storage with access to 15-year contracts.

Of the 3.3GW of battery storage capacity that secured contracts for the recent T-4 auction (2025-26), 1.7GW of this was battery storage with durations of 2 hours or more, signalling increased investment and a shift to the larger systems.

When considering their battery investment strategies, LCP has highlighted some key factors for investors to consider:

- Investors will need to be wary in the BM as more battery capacity is added to the market, as the amount of volume that each unit can be expected to deliver will reduce.

- Investors should consider co-location of batteries alongside other renewable energies such as solar, as a way of spreading their costs over a wider revenue base and maximising the use of limited connection capacity.

- The frequency response market remains attractive but investors must consider hybrid approaches that optimise between that and energy markets in order to maximise returns.

- Investors must consider volatility as a core component to their revenue stack and to be bankable, rather than it being treated as a “cherry on top”.

- While tempting, investors should be cautious when analysing leaderboards and should increasingly be taken with a pinch of salt as strategies become more complex and sources of revenue through different trading approaches are not visible

Matson added, “To date, batteries have primarily focused on supporting the energy system through the frequency response markets but in the coming years we are likely to see a change as these markets become oversubscribed. We have begun to see new strategies adopted to maximise returns not only from frequency but also from wholesale and balancing markets which offer a great opportunity for investors to stack their revenues.

“The frequency response market will still be an important revenue source for shorter duration systems, but asset owners will increasingly be looking towards the lucrative opportunities in wholesale and balancing due to the current market conditions.

“For investors, as well as considering the right strategy that works across both one and two-hour durations, they will also need to consider where they are building the assets. Co-location alongside generation such as solar PV could offer long-term savings as investors make the best use of connection capacity and spread the cost over a larger revenue base.”