The Israel-Hamas conflict, strikes at an LNG conversion plant in Australia & disruptions to the Finnish Balticonnector are among causes set to keep predicted price cap levels above £1,900 until the end of next year.

That’s the forecast of analysts Cornwall Insight, in a latest prediction reflecting the labrynthine global interdependencies of energy economics.

Growing volatility in international wholesale energy markets has already pushed up forecasts for the 2024 UK price cap for home supply, or the Default Tariff Cap, as regulator Ofgem terms it.

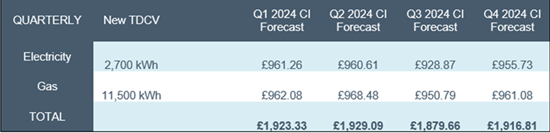

The analysis firm says latest predictions place a typical dual fuel consumer’s January energy bill at £1,923 per year, based on Ofgem’s new official yearly usage benchmarks of 2,700 kWh of electricity and 11,500 kWh of gas. A near-negligible rise to £1,929 is foreseen in April 2024.

While already predicted to increase in January, the cap had been expected to fall below the current £1,834 typical bill rate for the rest of 2024, Cornwall notes.

Figure 1: Cornwall Insight’s Default Tariff Cap forecasts using new Typical Domestic Consumption Values (dual fuel, direct debit customer)

Source: Cornwall Insight

Uncertainties such as Israel’s war with Hamas, and the disruptions in Finland and Australia have put paid to those hopes. Since September, forecasts for the cap have nudged up by as much as 6% Best current forecasts have the price cap remain above the current level at least until the end of the year.

Cornwall notes that Britain’s increasing reliance on internationally sourced liquid gas, as it moves away from Russian supplies, has made it particularly susceptible to flutters in the LNG market.

The ramifications of events in Gaza, which caused production to cease at key Israeli gas fields, saw lower gas output to Egypt where it is processed into LNG, impacting supply and prices. In Australia, strikes have cut production, reducing LNG exports and affecting some of the country’s main assets.

While unrelated to the Gaza conflict, Finland’s Balticconnector experienced interruptions which raised questions about the potential for similar damage elsewhere. Global wholesale markets have reacted as they rationally should, Cornwall notes, once again pushing up prices.

“The uncertainty over potential disruption going into winter will raise more questions over the supply-demand balance as temperatures start to decline”, in Cornwall Insight’s view.

Dr Craig Lowrey, principal consultant at the respected firm, observed:

“The jump in price cap predictions since September has once again highlighted the vulnerability of UK energy prices – and customer bills – to geopolitical events. The Russian invasion of Ukraine demonstrated there is a delicate balance in the global energy market which can easily be disrupted by unexpected events, it looks as though the current situation is repeating that pattern.

“The government needs to take steps to proactively limit the impact that such situations have on the UK’s energy market, and already stretched households, rather than reacting to events as they occur. Stop-gap measures such as social tariffs and one-off payments are helpful, but they are not a long-term solution”, Lowrey advised.

“While the UK will never be entirely protected from global price increases, reducing the country’s reliance on imported energy and prioritising sustainable, domestically sourced energy will help protect the country from international energy shocks, and work to stabilise prices over the next decade.”